The impact of ESG metrics on small business loans has been beneficial due to the ease of capital access, lower risk perception, etc.

In a rapidly evolving business landscape, Environmental, Social, and Governance (ESG) metrics have emerged as a pivotal tool for companies of all sizes to assess their sustainability practices and long-term viability.

While ESG metrics have gained substantial traction among large corporations, the impact of ESG metrics on small business loans cannot be underestimated.

ESG metrics have gained significance beyond just measuring a company’s ethical stance, and one area where their impact is increasingly felt is in the realm of loan approvals.

The impact of ESG metrics on small business loans are now influencing lending decisions, bringing forth both potential benefits and challenges for businesses seeking financing.

In the ever-evolving landscape of finance, the integration of ESG metrics is revolutionizing the way small businesses secure loans.

While traditionally, small loans were assessed solely on financial factors, the introduction of ESG metrics is ushering in a new era where sustainability and responsible business practices hold unprecedented influence.

In this article, we will delve into the impact of ESG metrics on small business loans, exploring how they reshape lending criteria, unlock opportunities for small businesses, navigate the challenges and embrace the opportunities presented by these indicators, paving the way for a more sustainable financial ecosystem.

Understanding ESG Metrics: A Primer

ESG metrics encompass a range of indicators that evaluate a company’s performance across three interconnected dimensions: Environmental, Social, and Governance.

Environmental metrics gauge a company’s environmental impact, energy consumption, waste management, and efforts to reduce carbon emissions.

Social metrics delve into employee relations, community engagement, diversity and inclusion, and contributions to the broader society.

Governance metrics assess the company’s leadership structure, transparency, ethics, and compliance.

The ESG Revolution in Small Business Lending

While the impact of ESG metrics on small business loans is stressed, it goes beyond the conventional financial indicators when assessing a company’s eligibility for a loan.

They provide a comprehensive framework to evaluate a business’s environmental impact, social responsibility, and governance practices.

This transformation is driven by a broader recognition that a company’s sustainability efforts can significantly impact its long-term viability and creditworthiness.

Relationship between ESG Metrics and Loan Approvals

The conventional way of approving loans had been primarily based on financial indicators such as credit history, collateral, and cash flow. While these financial aspects remain crucial, ESG metrics add a layer of depth to the evaluation process.

Lenders are recognizing that a company’s commitment to sustainable practices can impact its long-term viability and risk profile, ultimately affecting its ability to repay loans.

Businesses with strong ESG performance are viewed as better equipped to navigate environmental, social, and ethical challenges, reducing the perceived credit risk associated with unforeseen disruptions.

The Relevance to Small Businesses

While it has often been associated with large corporations due to their vast resources and global reach, the applicability and impact of ESG metrics on small business loans is equally profound.

ESG metrics can offer several compelling advantages to small businesses that align with their unique characteristics.

1. Improving reputation

Small businesses often operate within tight-knit communities, making their reputation a vital asset. Adopting robust ESG practices can foster positive relationships with customers, employees, local communities, and investors.

Demonstrating commitment to environmental sustainability and responsible governance can enhance brand trust and attract socially conscious consumers.

2. Attracting investment and capital

ESG considerations are gaining prominence among investors who view sustainability practices as indicative of long-term business resilience.

Small businesses with strong ESG performance can stand out in the eyes of investors, thereby increasing their access to capital and potential for growth.

3. Increase in employees

Talented employees are increasingly drawn to companies that align with their values. Small businesses that prioritize ESG factors create a more appealing work environment, fostering employee loyalty and reducing turnover rates.

4. Ease in managing risks

ESG metrics provide a framework for identifying potential risks and weaknesses in a business’s operations.

By addressing environmental, social, and governance concerns proactively, small businesses can mitigate risks and ensure their sustainability over the long term.

5. Adaptation

As governments worldwide intensify their focus on sustainability and ethical business practices, regulations are evolving accordingly.

Small businesses that incorporate ESG metrics into their strategies can stay ahead of regulatory changes, avoiding compliance issues and associated penalties.

Challenges for Small Businesses

While the advantages and impact of ESG metrics on small business loans are clear, there are challenges to navigate as well.

1. Resource constraints

Small businesses often lack the financial and personnel resources required to implement comprehensive ESG programs. However, focusing on key areas that align with the business’s values and operations can yield meaningful results.

2. Data collection and reporting

Accurate data collection can be challenging for small businesses with limited resources. However, with the aid of technology and simplified reporting frameworks, data collection can become more manageable.

3. Balancing short-term pressures

Small businesses frequently face immediate financial pressures that can overshadow long-term sustainability efforts. Striking a balance between short-term needs and long-term goals is crucial.

Positive Impact of ESG Metrics on Loan Approval

Here are some impact of ESG metrics on small business loans:

1. Access to capital

Small businesses often face challenges in accessing capital due to their limited resources and shorter operational history.

Embracing ESG metrics can provide them with a competitive edge, making them more attractive to lenders who seek businesses aligned with responsible practices.

This increased appeal enhances the likelihood of loan approval and potentially results in better loan terms. It also emphasizes the impact of ESG metrics on small business loans.

2. Enhanced credibility

Companies with strong ESG performance exhibit responsible business practices, which can enhance their credibility in the eyes of lenders. This encourages more optimistic loan terms and reduces the interest rates.

3. Lower risk perception

Lenders perceive companies with robust ESG practices as better equipped to manage risks associated with environmental and social challenges. This can translate to reduced perceived credit risk, making loan approval more likely.

4. Lower interest rates

Businesses with strong ESG performance are considered less risky due to their proactive approach to managing risks related to sustainability. As a result, they may qualify for lower interest rates, saving them money over the life of the loan and improving their financial sustainability.

5. Access to green financing

Emphasizing on the impact of ESG on small business loans, Many financial institutions offer specialized green financing options designed to support environmentally friendly initiatives.

Businesses with positive ESG metrics may gain access to these specialized funding sources.

6. Alignment with stakeholder values

Lenders recognize that companies that prioritize ESG factors resonate with stakeholders such as customers, employees, and investors.

Demonstrating alignment with societal and environmental concerns not only strengthens a company’s reputation but also showcases a commitment to long-term viability, a factor that lenders appreciate.

7. Long-term viability assessment

ESG metrics enable lenders to assess a company’s long-term viability by considering its resilience to environmental and social changes.

This perspective allows lenders to make more informed decisions about the sustainability of the business beyond short-term financial indicators.

Negative Impact of ESG Metrics on Loan Approval

Despite the impact of ESG metrics on small business loans, several challenges need due consideration.

1. Processing of data

Gathering and reporting accurate and comprehensive ESG data can be challenging for companies, particularly smaller ones with limited resources.

Inconsistent or incomplete data could hinder a company’s ability to demonstrate its ESG performance effectively. Overcoming this challenge requires investing in systems that streamline data collection and reporting processes.

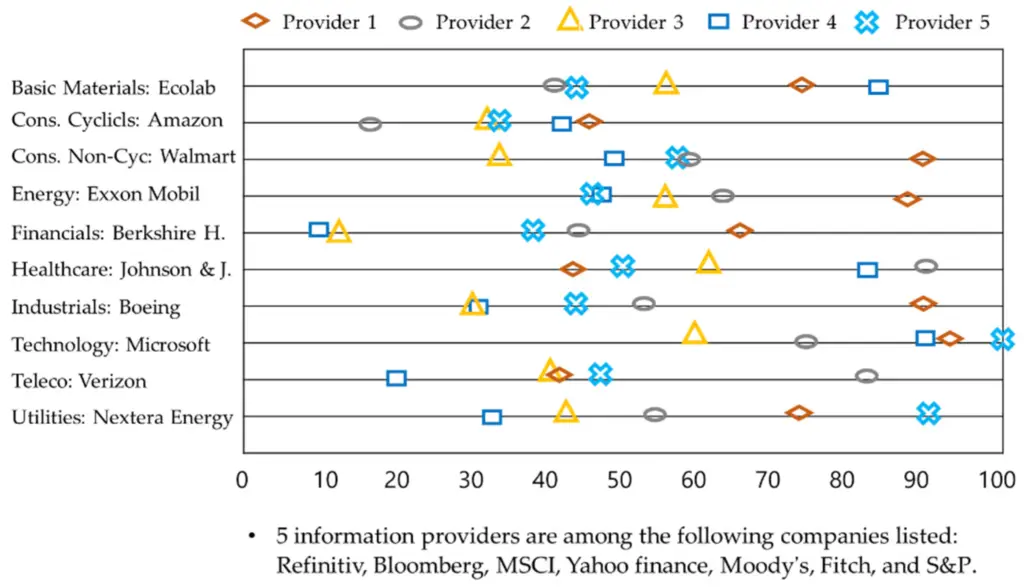

2. Subjectivity and Standardization

ESG metrics are diverse and can be subjective, making it difficult to establish universal standards for evaluation. Lenders may use different criteria, leading to inconsistencies in loan approval decisions.

3. Perceived costs

Implementing ESG initiatives might involve upfront costs, which could be perceived as a financial burden by some businesses. There should be a balance between investing short term and getting sustainability in the long run.

4. Lack of understanding

ESG metrics encompass a broad range of factors, and not all companies fully understand their significance or how to measure them accurately.

This lack of understanding can hinder a company’s ability to effectively communicate its ESG efforts to lenders.

Redeeming the Negative Impact of ESG Metrics on Loan Approvals

1. Transparency

To address challenges related to data collection and reporting, companies should prioritize transparency. Clearly communicate their ESG initiatives, efforts, and progress to lenders, accompanied by accurate and well-documented data.

2. Prioritize ESG strategy

Small businesses should develop a clear ESG strategy that aligns with their values and industry. Demonstrating this strategy to lenders shows a proactive approach to sustainability and limits the worries of potential costs.

3. Invest in technology

Embracing technology can facilitate data collection, analysis, and reporting of ESG metrics. Automation tools can help small businesses efficiently manage their sustainability efforts.

4. Engage with experts

Understanding the importance of ESG metrics on small business loans, collaborating with sustainability consultants or experts can help small businesses navigate the complexities of ESG metrics, ensuring accurate data collection and reporting.

5. Educate stakeholders

Educating employees, customers, and investors about the company’s ESG initiatives can strengthen its reputation and demonstrate its commitment to responsible practices.

6. Engage with lenders

Companies can engage in open conversations with lenders to understand their specific ESG criteria and how they factor into loan evaluation. This dialogue can help businesses tailor their ESG efforts to meet lender expectations.

Embracing ESG Metrics: Practical Steps for Small Businesses

Small businesses can adopt a gradual and focused approach to integrating ESG metrics into their operations.

1. Identify relevant metrics

Determine which ESG metrics align with the business’s values, industry, and operational scale. Prioritize the most impactful indicators to focus efforts effectively.

2. Set achievable goals

Establish realistic ESG goals that can be integrated into the business’s strategic plans. Start small and build on success over time.

3. Enhance stakeholder engagement

Engage with customers, employees, and local communities to understand their expectations and concerns. Incorporate their feedback into ESG initiatives for greater relevance.

4. Collaborate with partners

Form partnerships with suppliers, distributors, and other stakeholders who share similar ESG values. Collaborative efforts can amplify the positive impact of ESG metrics on small business loans.

5. Communicate transparently

Transparent communication about ESG initiatives and progress builds trust with stakeholders. Small businesses should openly share their successes, challenges, and plans for improvement.

Conclusion

The impact of ESG metrics on small business loans cannot be under-emphasized. They are no longer confined to corporate boardrooms; they are altering the landscape of small business lending.

As business practices continue to evolve, ESG metrics serve as a beacon of hope towards financial success, sustainability, and a brighter future for small businesses.

Related posts:

- 389 Adjectives Starting with Z (Positive Words and Others) - January 12, 2024

- 389 Adjectives Starting with Y (Positive words and Others) - January 11, 2024

- 389 Adjectives Starting with X (Positive words and Others) - January 10, 2024